May market update

Written by Jack Lucas, Customer support. Market update for Monday 12th May.

As we enter the winter months, livestock producers are responding to a shifting market landscape shaped by seasonal conditions, international trade dynamics, and changing buyer behaviour. May saw steady cattle prices despite rising listings, while the sheep and lamb market remained strong amid dry conditions in the south. In this month’s update, we break down the latest cattle and sheep market movements, highlight key industry developments, and explore what they could mean for your operation.

Cattle market overview

The Australian cattle market has shown resilience amid challenges such as the introduction of US tariffs and reduced processor demand due to public holidays in April. Despite these hurdles, cattle prices have remained steady. The MLA reported a significant surge in cattle listings, with 27,080 head offered, the platform’s third-highest weekly offering. This increase is attributed to factors like worsening drought conditions in the south, prompting producers to offload stock. Notably, steers over 400kg experienced a price lift, averaging 128c/kg more than the previous week, while PTIC heifers and cows saw positive price swings of 250 and 268c/kg respectively. However, the clearance rate dipped to 63% due to the sudden influx of listings.

Sheep and lamb market overview

In the sheep and lamb sector, a 30% rise in listings, totalling 48,666 head. This uptick is linked to dry conditions in southern regions, leading to increased supply. Crossbred lambs performed well, with a 94% clearance rate and a $16 increase in the Crossbred Lamb Indicator to 165c/kg. Composite/other breed lambs also saw a 14c rise to 177c/kg. New South Wales led both in supply and demand, contributing over half of the national offering and securing a significant share of purchases. Processor activity increased, accounting for 20% of total purchases, indicating robust demand in the processing sector.

These developments underscore the dynamic nature of Australia’s livestock markets, where factors like weather conditions and international trade policies play pivotal roles. Producers and stakeholders must stay informed and adaptable to navigate these evolving landscapes effectively.

Industry news

Beef exports see a surge in the face of tariffs

Beef exports saw a significant 21% year-over-year increase in April 2025, reaching 127,172 tonnes. This growth was particularly strong in exports to the U.S. (up 37%) and Canada (up 40%), with grain-fed beef shipments to China also experiencing a substantial 62% surge. This expansion occurred even after the former U.S. administration announced a 10% tariff on Australian goods earlier in April. The MLA credits this positive trend to greater livestock availability and strong international demand. In contrast, other Australian meat sectors experienced a downturn in exports during the same period, with sheepmeat, mutton, lamb, and goatmeat declining by 3%, 5%, 1%, and 15%, respectively.

Elders buys Delta Agribusiness

Farmers are worried that Elders’ $475 million bid to acquire Delta Agribusiness could create a farm supply duopoly similar to Coles and Woolworths’ supermarket dominance. The Australian Competition and Consumer Commission (ACCC) will decide on the merger by May 29. In case the ACCC requires divestments, some small groups are considering buying stores.

Resilience within the agricultural sector

The Australian agricultural sector remains resilient, according to the Department of Agriculture, Fisheries and Forestry’s Snapshot of Australian Agriculture 2025. The sector has experienced production growth, with approximately 70% of output being exported. Farm employment and incomes have increased in recent years. Despite this growth, challenges such as climate variability and slowing productivity remain. The report also notes the increasing global focus on emissions and sustainability, requiring the sector to adapt to these evolving priorities.

Despite the varied challenges producers across the country are facing, the markets are holding steady with strong buyer interest and solid export demand. Stay tuned for next month’s market update as we keep tracking the trends that matter most to your operation.

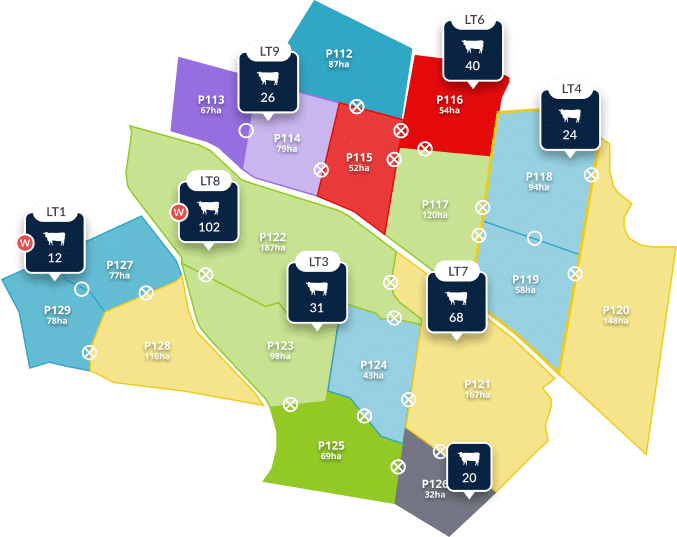

If you’d like to see how AgriWebb can improve the resilience of you livestock operation, click here to start your free 14 day trial or chat to the team today 02 8311 4675.